Apple Pay has hit its 10 year anniversary mark today and the company is celebrating with a bunch of announcements including new installment payment options, rewards redemption, extended access. across third-party browsers, as well as other upcoming features.

Apple Pay – 10 year anniversary

The company says that Apple Pay is now used by millions of consumers in 78 markets and is supported by more than 11,000 banks and network partners across iPhone, iPad, Mac, and Apple Watch. Apple Pay is beloved specially due to its ease of use, privacy and security, and over 85% customers are very satisfied or extremely satisfied with the service.

Here are all the announcements that Apple has made today:

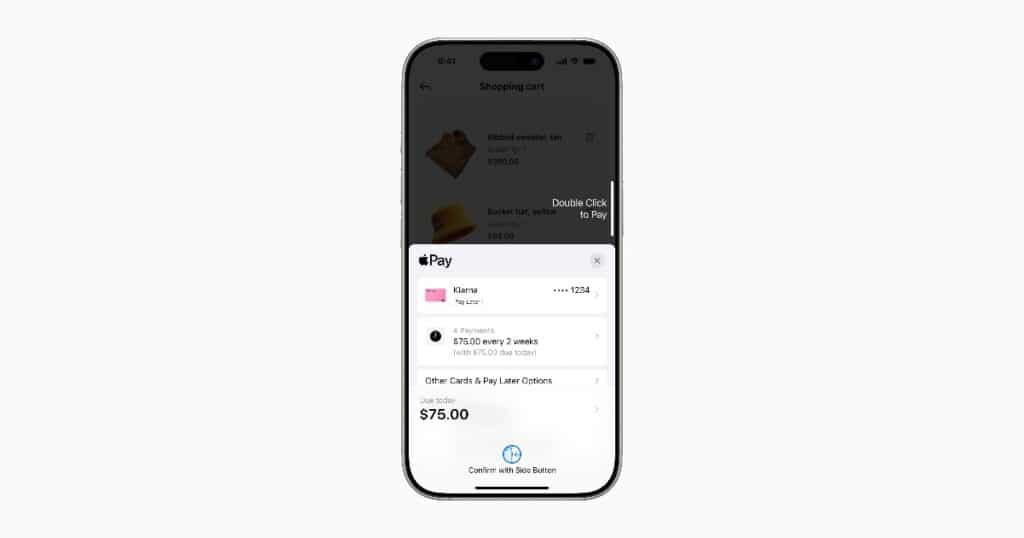

Installment Plan Options

Apple had killed off its own installment plan service in the United States not so long ago, but it has been quick to replace it with other options. With iOS 18, users can access installment plans for their purchases with Affirm in the United States, and Monzo Flex in the United Kingdom, when using Apple Pay online or in-app on iPhone and iPad. Today onwards, users will also be able to use Klarna’s flexible payment options both online and in-app.

Apple also plans to add more installment payment options from eligible credit or debit cards when making online purchases with Apple Pay in the U.S. with Citi, Synchrony, and across eligible, participating Apple Pay issuers with Fiserv; in Australia with ANZ; in Singapore with DBS; in Spain with CaixaBank; and in the U.K. with HSBC, NewDay, and Zilch. The company will continue to add more issuers in different markets over time.

Rewards

Apple Pay users in the United States can also redeem rewards now with eligible Discover credit cards, when using the service. In the future, users will be able to redeem rewards for purchases with Apple Pay in the U.S. with Synchrony and across eligible, participating Apple Pay issuers with Fiserv and FIS, and in Singapore with DBS. The company will add more issuers over time.

Third-party web browsers

Users will be able to use Apple Pay on third-party web browsers and computers soon. During checkout, users will be asked to use their iPhone or iPad, running iOS 18 or iPadOS 18 or later, to scan a code, which will allow them to complete the payment using Apple Pay on their device. This is not a seamless process, but it’s still better than not having an option.

Tap to Provision

A new feature called Tap to Provision will allow users to add their credit or debit card to their Apple Wallet by tapping the card to the back of their iPhone. This will require the card’s NFC technology to be functioning and activated.

PayPal

In 2025, U.S. customers will be able to view their PayPal balance when using their PayPal debit card in the Apple Wallet app. It is unclear when this feature will be made available to other services and in other countries and regions.

Subscribe to our email newsletter to get the latest posts delivered right to your email.

Comments